26+ mortgage deferred payment

Web Forbearance is when your mortgage servicer thats the company that sends your mortgage statement and manages your loan or lender allows you to pause or reduce your payments for a limited period of time. Offering payment deferral program for mortgages and home equity loans or lines of credit as well as waiving late payment fees on each type of home loan product.

Business Succession Planning And Exit Strategies For The Closely Held

The mortgage loan is 30 or 60 days past due ie the borrower is not past due for more than two full monthly contractual payments.

. Interest will not be charged on the total past-due amounts to be deferred. Web Deferred interest mortgages are mortgages that offer lower interest payments at the beginning of a loan with loan payments either increasing over time or due later in one lump sum. Web A homeowner may be eligible for a payment deferral plan if.

Web Family First. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Answer Simple Questions See Personalized Results with our VA Loan Calculator.

A mortgage deferral allows borrowers to move past-due house payments to the end of their loan term. Youll have to repay any missed or reduced payments in the future. Web In general there are three deferred payment definitions of how your loan is restructured after you start paying your installments again.

For example if you defer payments for three months your loan term switches from 30 years to 30 years and three months. Web The COVID-19 payment deferral may be the best option for you if your COVID-19 related hardship has been resolved and you are able to continue making your full monthly mortgage payment but cannot afford a full reinstatement or a repayment plan to bring your mortgage loan current. Web If you have a cash flow interruption because of your employment and you need to defer your payment for 30 60 90 days call us up Bank of Americas CEO Brian Moynihan told CNBC on Friday.

Web A payment deferral brings your mortgage current and delays repayment of certain past-due monthly principal and interest payments as well as other amounts we paid on your behalf related to the past-due monthly payments. You preserve cash for more important areas such as food and necessities. The payment deferral will not change any.

Web A mortgage deferral can be used after a forbearance and Fannie Mae and Freddie Mac allow 18 months of past-due mortgage payments to be deferred due to coronavirus-related events. When these deferred interest amounts are due and how much interest payments increase depend on the loans terms. Avoid Higher Debt Credit.

Web Financial flexibility when you need it. The recently announced COVID-19 Payment Deferral solution returns a homeowners monthly mortgage payment to its pre-COVID amount by adding up to 12 months of missed payments to the end of their. Your mortgage lender agrees not to foreclose on your home for that predetermined time period.

Forbearance does not erase what you owe. Web Millions of homeowners whove lost their incomes qualify to defer payments. Web Tack the missed payments onto the end of your loan term.

Web What is COVID-19 Payment Deferral. Calculate Your Monthly Loan Payment. Increasing Mortgage Payments Could Help You Save On Interest.

NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You. Pausing mortgage payments could help you cover other necessities. Web TD Bank.

You may find it easier to cover the cost of groceries and healthcare during tough times. You do not have to cash in investments which are at a low. Web For homeowners who have been struggling to pay their mortgage due to coronavirus-related shutdowns the ability to delay their payments through mortgage forbearance programs has been a huge relief.

Web A deferred interest mortgage or an interest-only mortgage is a mortgage that allows the borrower to delay making interest payments on the loan for a specified period of time. Ad See If Youre Eligible for a 0 Down Payment. It can be for a few months or up to a year depending on the terms of your agreement.

And the past-due status has remained unchanged for at least three consecutive months including the month of evaluation. But many say lenders are demanding unfair terms such as massive subsequent lump sum payments that they cant afford. Increased payments - same term Suppose your lender does not restructure your original amortization term that is your loan term will remain the same.

It helps your family because you reduce your mental stress and financial stress. Credit cards are 19. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web Usually your loan payments under forbearance are either reduced or suspended for a predetermined period of time.

Deferred Payment Meaning What It Is How To Use It More

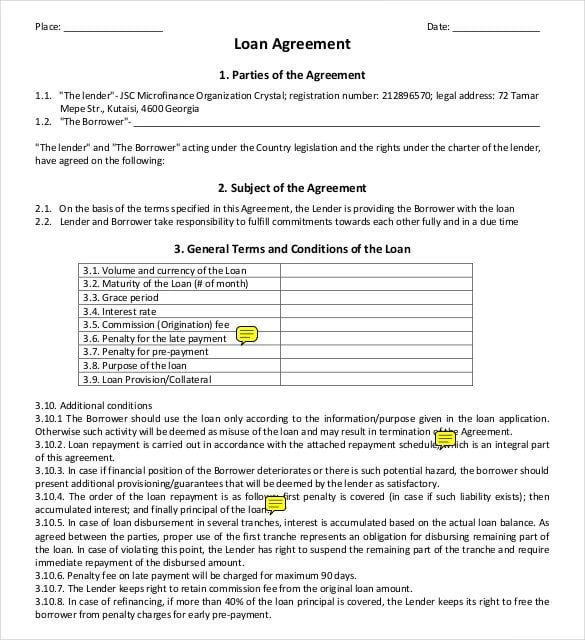

27 Loan Contract Templates Word Google Docs Apple Pages

Deferred Payments Advice On Care Impartial Care Fees Consultant

The Impact Of Deferred Payment Terms Collection Hub

Free 8 Sample Hardship Letter Templates In Ms Word Pdf

Deferring Your Mortgage Payment Due To Coronavirus What You Need To Know Fortune

Should You Skip A Mortgage Payment During The Pandemic Mortgages And Advice U S News

What Is A Deferred Payment Plan Possible Finance

Biden S New Mortgage Relief Program Could Reduce Payments By 25 Forbes Advisor

Pin By Mark Fleming On Work Contract Template Loan Money Loan

Free 53 Payment Letter Formats In Ms Word Google Docs Pages Pdf

America S Five Larges Banks Agree To Defer Mortgage Payments For Customers Impacted By Covid 19 Daily Mail Online

Deferred Payment Definition Details And Quiz Business Terms

Mortgage Forbearance Vs Deferment What S The Difference Fortune Recommends

Banks Offering Deferment On Mortgage Payments During Coronavirus

Homeowners Hurt By Covid 19 Can Delay Mortgage Payments But Some Say They Re Anxious And Confused About The Real Cost National Association Of Real Estate Brokers

America S Five Larges Banks Agree To Defer Mortgage Payments For Customers Impacted By Covid 19 Daily Mail Online